The ongoing future of Low-Earnings, Less than perfect credit Mortgage brokers

not, there are exceptions, and get a home loan when you have crappy borrowing from the bank and you can low income. Low income, less than perfect credit mortgage brokers get popular much more anybody deal with financial difficulties.

Nobody understands the near future, nevertheless following the are some things can expect away from low-money lousy credit lenders:

Concept of Low income and Poor credit

Later on, we provide the phrase reasonable-money and poor credit criteria for lenders to improve. They may not transform far and can seriously be varied than what they’re today.

Today, bad credit implies that you have got an effective FICO score of faster than just 620 , a personal debt to earnings ratio in excess of 43%, an advance payment regarding less than 5%, and you can a severe credit experience on the earlier, instance, filing for bankruptcy.

Youre believed a minimal-earnings private in the event the income is tough to prove or do not qualify not as much as conventional home loan guidelines. Lenders tend to customize the above meanings to accommodate way more home loan individuals in the future.

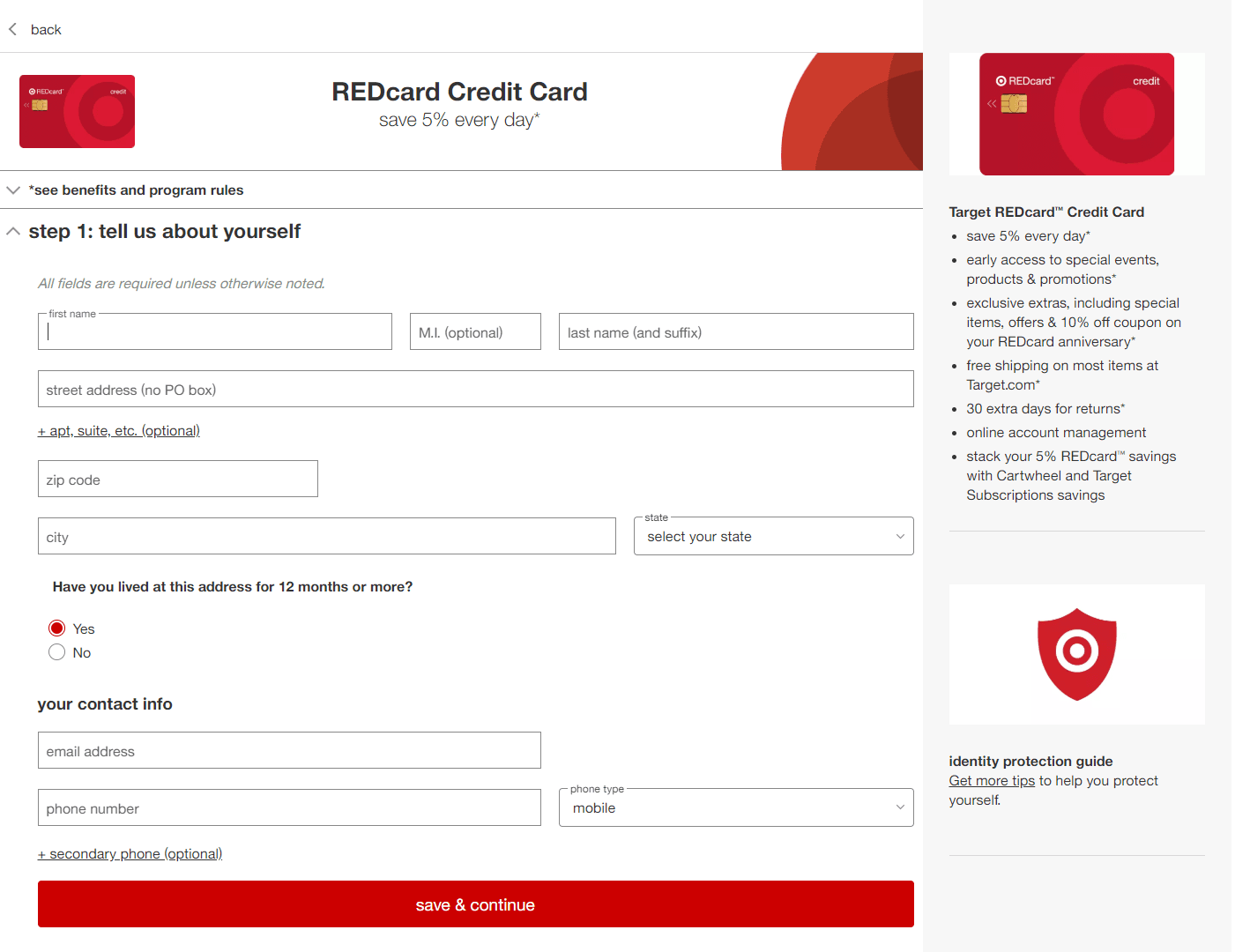

A bank can ascertain you may be low-income centered on the proof of money for those who have one to. In case you happen to be self-employed, like, you can make instant shell out stub copies online thru other sites instance PDFSimpli and complete those individuals away since your proof of earnings.

A whole lot more Mortgage Options

Mortgage lenders still have to profit regardless if anyone secure lower profits while having worse borrowing from the bank. Thus, you ought to expect a whole lot more choices for reasonable-money, less than perfect credit home loans afterwards.

Such as for example, choice mortgage lenders eg Loan Depot can help you rating reasonable financial prices . Individuals who can also enjoy special programs for example FHA and you will Va funds continues to go up.

Homebuyer Preparing

Like with many other anything in life, planning is the vital thing to help you profits. Subsequently, you ought to assume a lot more homebuyer preparation for lower-income, poor credit mortgage borrowers, especially first-time buyers personal loans online Illinois.

More home buyers would need to deal with homebuyer knowledge and you can financial fitness courses to ensure they are on the most useful profile you’ll be able to despite less than perfect credit and you may low income.

Homeowners can also be learn every expenses associated with to find property, simple tips to improve their credit rating, while having the best home loan costs you’ll. These applications increases, making it easier getting reasonable-money those with bad credit discover mortgage brokers.

Finest Risk Feedback

Even when two some one elizabeth disappointing income and you will credit rating, they might angle various other degrees of exposure to a mortgage lender. On the increased the means to access technical and accessibility borrowers’ research than ever before, mortgage brokers will be able to carry out ideal exposure feedback.

Thus, there is highest conditions to own reasonable-income and less than perfect credit lenders. Moreover, lenders can charge the proper rates because they have best exposure investigations practices, such as for example, having fun with AI to have chance data. Might understand the most practical way to achieve money whenever financing in order to reduced-income, bad-borrowing from the bank individuals.

Less expensive Property

Since lowest-money and you can poor credit anybody raise, race among people to incorporate less expensive casing will increase. There is going to and therefore be much more affordable houses gadgets created to offer more people towards window of opportunity for home ownership.

You can expect less expensive houses options to develop, such as for example, cellular and you may prefabricated belongings. The low-prices family helps it be more relaxing for borrowers to track down fund and you will loan providers to receive costs.

You will see of a lot alterations in the near future when it comes to household money for bad credit and lower-income some body. Most useful chance critiques, cheaper housing, significantly more home loan possibilities, homebuyer thinking, and you may alterations in the phrase low-money & poor credit will vary later on. The level of the alterations differ with regards to the alter regarding the monetary issues affecting owning a home.